By Meriem Gaval

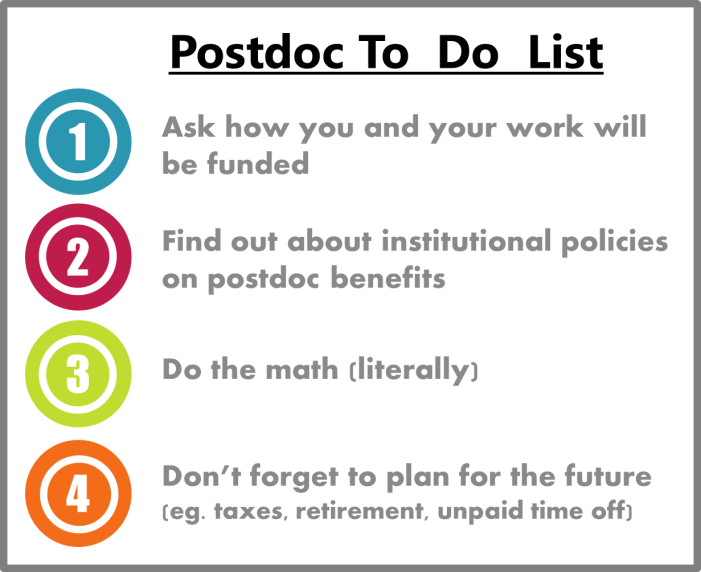

If you’re planning on seeking a post-doc you’ll discuss your interests, skills, and ideas with future PIs and labmates during your interview. Sometime between your research talk and dinner you may discuss your potential salary and sources of funding but it is unlikely that you will hear about the additional benefits provided to postdocs at the institution. This supplementary compensation includes health and life insurance, paid time off, parental leave, and retirement plans, all very important things that will influence your lifestyle choices over the next several years.

If you’re planning on seeking a post-doc you’ll discuss your interests, skills, and ideas with future PIs and labmates during your interview. Sometime between your research talk and dinner you may discuss your potential salary and sources of funding but it is unlikely that you will hear about the additional benefits provided to postdocs at the institution. This supplementary compensation includes health and life insurance, paid time off, parental leave, and retirement plans, all very important things that will influence your lifestyle choices over the next several years.

There are many different ways to gain postdoctoral experience and, while the work expectations are very similar between these settings, your compensation and benefits are very different. These may not even be standardized across all postdocs within an organization! Some seemingly obvious choices can also radically alter the benefits you receive. What we’d like to do next is briefly discuss some of the benefits currently provided to postdocs in different circumstances, with the intention of arming you with knowledge to guide your questions during interviews and help you make informed decisions about your next career move.

If your new postdoc is in an industry setting, chances are your employee benefits will be very similar or the same as other company employees. These will include a retirement plan with employer contribution, clearly set guidelines for paid time off, health and life insurance, and the ability to contribute to the national social security program. The NIH intramural research program has defined paid time off rules and provides health insurance at no cost to the postdoc, but does not provide access to retirement benefits or social security contributions.

The compensation of postdocs working in academic institutions varies wildly, and this depends on the institution, departmental affiliation, and source of funding. Some common sources of funding include departmental funding, grants awarded to and managed by your PI, an institutional training grant such as a T32, or an individual training grant such as an NRSA. If your salary is being paid by your PI’s grant(s) or by the university itself, in many cases you are considered an employee and are eligible for benefits provided to full-time staff such as health and life insurances, parental leave, retirement plan, and paid time off. On the other hand, if your salary comes from an institutional training grant (T32), many institutions will consider you a stipendee, not an employee. Stipendees are not always allowed to take advantage of the insurance group rate provided to employees, nor retirement benefits. In this case the stipendee would be responsible to purchase private insurance. While the NIH allows trainees up to 60 calendar days of parental leave, additional paid time off is to be determined by agreement with the advisor. T32s provide a training-related institutional allowance per fellow (NIH guidelines for 2014 are $7,850/year). These are most often used for travel and supplies, but the NIH considers health insurance a training-related expense. As such, your department or institution may require you to use this money to pay for your health insurance directly, or to partially reimburse you for your insurance-related out-of-pocket expenses, decreasing the amount of money you can use for travel and supplies. It is worth noting that some institutions will consider this allowance as income, so that your tax documents would reflect an additional $7,850 to your salary, even though this was not a direct compensation to you. Also, while employees are allowed pre-tax contributions to pay for public transportation, retirement, and insurance policies, stipendees are often not. This means you would pay taxes on a greater amount of taxable income.

What about competitive funding mechanisms? We have all heard of the importance and prestige of obtaining individual training grants, such as an NRSA. Unfortunately, when you obtain an NRSA as a postdoc, your employment status may change from employee to stipendee (this is the case at Emory). If this happens, the same financial pitfalls just described may apply to you. That’s right- if you obtain your own funding you may receive a bonus in salary from your PI, but you may also lose your health insurance as well as pre-tax contributions and employee matching to your retirement plan. If you are able to get benefits through your partner’s employer and decide to go that route, be prepared to spend time and effort justifying your new NRSA as a ‘life changing event’ to your partner’s employer, so you can enroll in their benefits outside of open enrollment.

We would argue that this is an unfortunate way to disincentive truly great funding mechanisms for training. However, these small but significant differences in your compensation package are not well-known and seldom talked about, so most trainees don’t realize the financial implications of the awards until after they’ve been accepted and disbursed. This is not meant to discourage you from applying to any fellowship or from pursuing a position with T32 funding. You should use this information to discuss the implications with your PI. Speak with your PI about ways to offset the financial drawback of obtaining a training fellowship. You may be able to negotiate a salary supplement, funds to travel to specific courses, workshops, or conferences, equipment, or hiring an undergraduate or technician to work on your project and increase your productivity.

It’s imperative to highlight that these issues are not the same at every institution or department. This is partly due to the lack of NIH requirements or guidelines for academic organizations to follow regarding compensation and benefits. Even the “NRSA salary minimum” is not required to be met if your compensation is coming from a non-NRSA funding mechanism. This pilot survey from the National Postdoctoral Association (NPA) will give you a good idea of the diversity in institutional policy regarding compensation. The NIH is aware of the desire to standardize benefits for postdoctoral researchers and recognizes that training grants carry a financial burden on the awardee, as seen in pages 7-9 of the report seen here. As you interview for postdoc positions be proactive and ask current postdocs in the lab and the department about these policies. They are a valuable source of information and can put you in contact with key personnel to answer your many questions. Find out if the institutions belong to the NPA and whether they have an office of postdoctoral research, as these are a reflection of support and commitment to improving the postdoc experience. Better yet, become involved with the advocacy committee in either or both of these organizations and help change the current system.

It’s imperative to highlight that these issues are not the same at every institution or department. This is partly due to the lack of NIH requirements or guidelines for academic organizations to follow regarding compensation and benefits. Even the “NRSA salary minimum” is not required to be met if your compensation is coming from a non-NRSA funding mechanism. This pilot survey from the National Postdoctoral Association (NPA) will give you a good idea of the diversity in institutional policy regarding compensation. The NIH is aware of the desire to standardize benefits for postdoctoral researchers and recognizes that training grants carry a financial burden on the awardee, as seen in pages 7-9 of the report seen here. As you interview for postdoc positions be proactive and ask current postdocs in the lab and the department about these policies. They are a valuable source of information and can put you in contact with key personnel to answer your many questions. Find out if the institutions belong to the NPA and whether they have an office of postdoctoral research, as these are a reflection of support and commitment to improving the postdoc experience. Better yet, become involved with the advocacy committee in either or both of these organizations and help change the current system.

For Emory, it seems this is the table that says it all: http://www.hr.emory.edu/eu/benefits/eligibility/residentspostdocs.html

Great points. At my first PostDoc appointment, PostDoc’s were essentially employees, with access to parental leave even, and from what I knew things were standardized across the institution. In my current PostDoc position (a different university), there are different classes of PostDoc, and PI’s get to choose which one it is, and they come with different pay scales and benefits.

Well summarized! One other thing to note is that many institutions will have a minimum required time before they will pay into a retirement account or before it vests (i.e. you get to keep the money in the account if you leave). It is not unusual for a post-doc to have multiple forms of support over the 5 – 7 years they will be somewhere. Thus if you transition from an employee to being a stipendee and then back again, your previous time as an employee will not count towards the retirement account, meaning you have to start your waiting period all over again (this is the case at my institution if more than a year has passed since being an employee). Sometimes this even has implications for when retirement benefits begin if you are lucky enough to get a faculty position.

This is great info. Thanks so much for writing, Meriem.